Operating Referendum

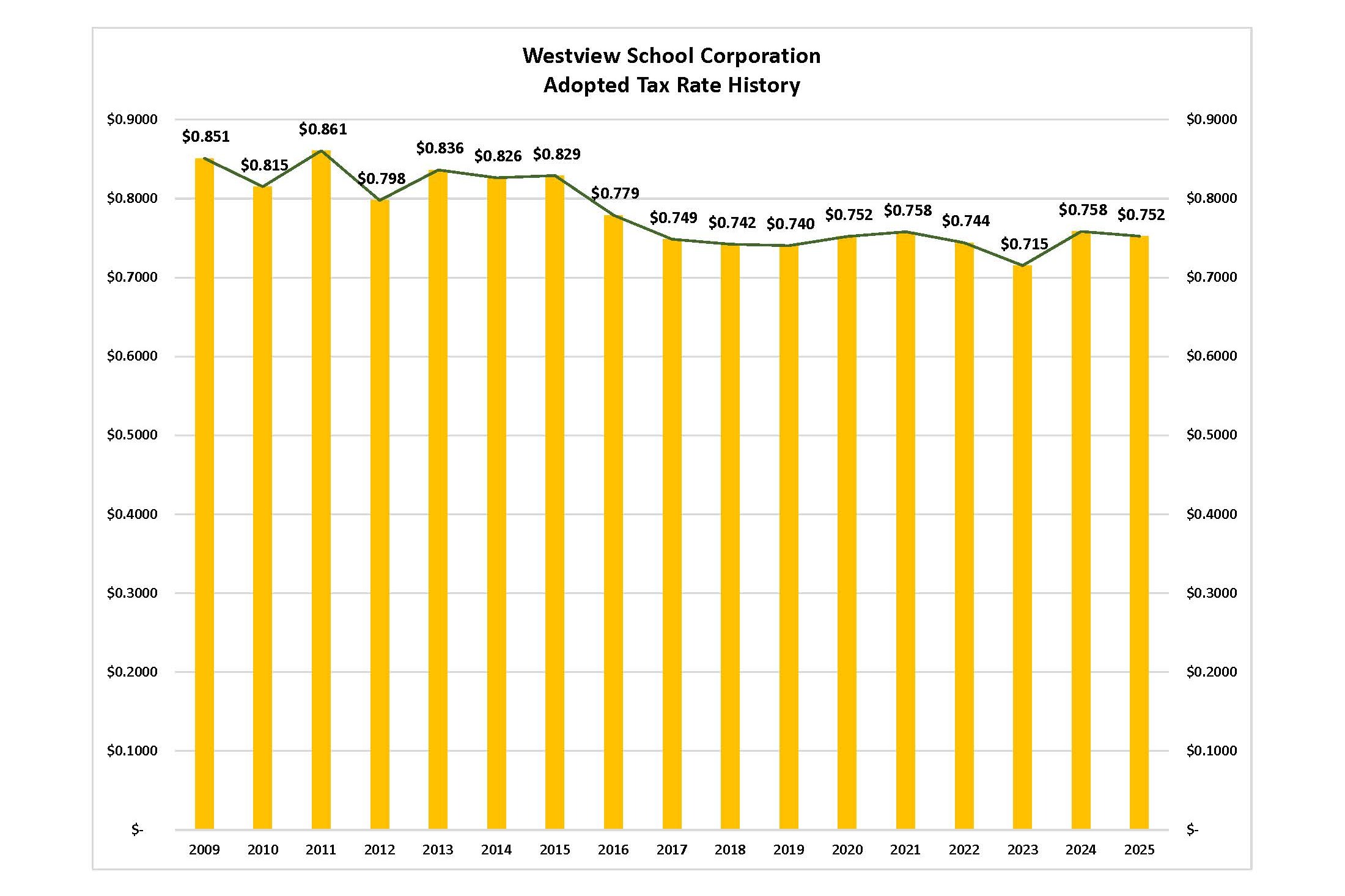

Renewal at the SAME TAX RATE

Click Image to Enlarge

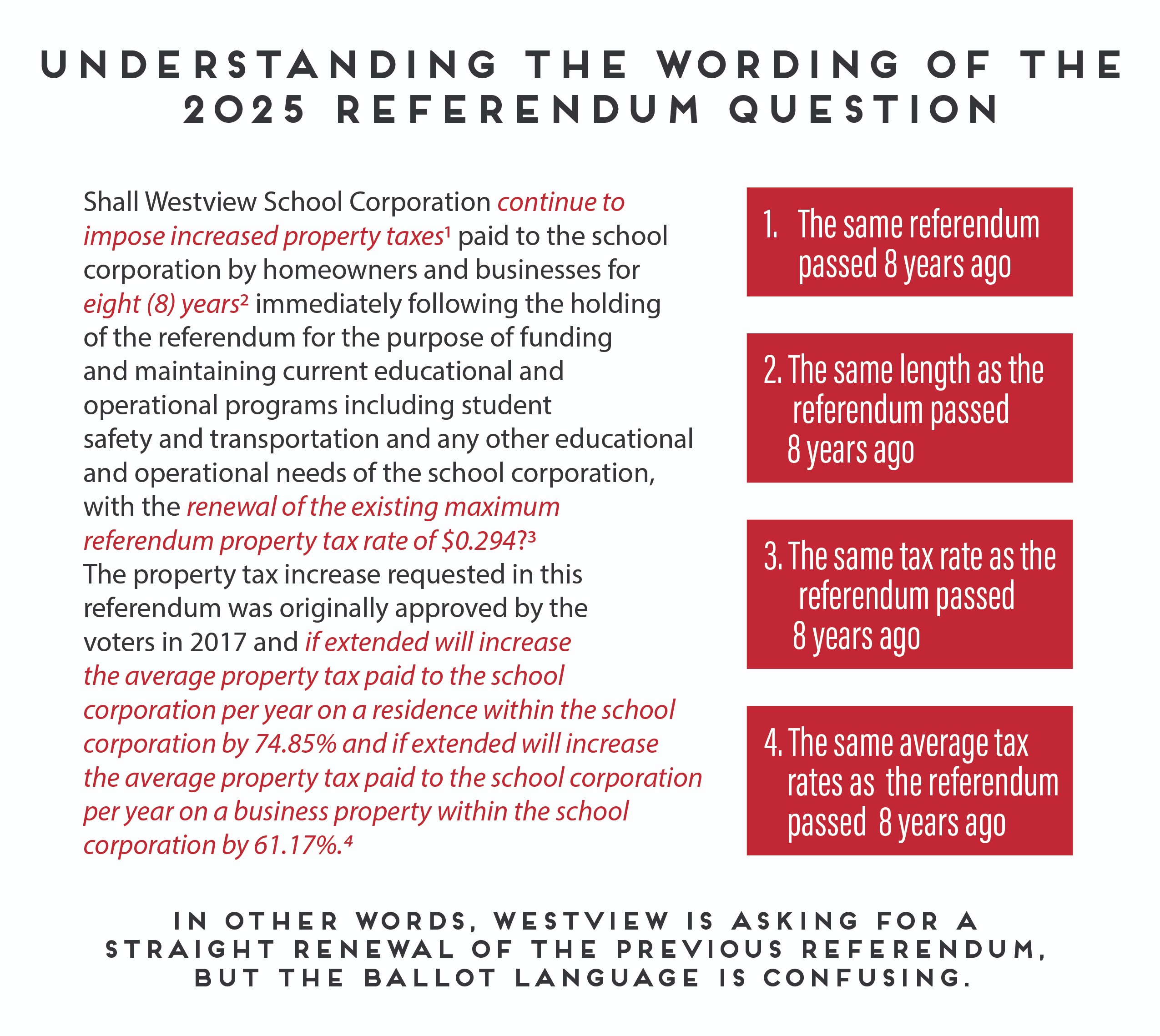

Understanding the Public Question

Will the Westview community give us renewed permission to spend local money to preserve high quality programs for our children?

2025 Referendum Question | 2017 Referendum Question |

|---|---|

Shall Westview School Corporation continue to impose increased property taxes paid to the school corporation by homeowners and businesses for eight (8) years immediately following the holding of the referendum for the purpose of funding and maintaining current educational and operational programs including student safety and transportation and any other educational and operational needs of the school corporation, with the renewal of the existing maximum referendum property tax rate of $0.294? The property tax increase requested in this referendum was originally approved by the voters in 2017 and if extended will increase the average property tax paid to the school corporation per year on a residence within the school corporation by 74.85% and if extended will increase the average property tax paid to the school corporation per year on a business property within the school corporation by 61.17%. | For the eight(8) calendar years immediately following the holding of the referendum, shall the Westview School Corporation impose a property tax rate that does not exceed Twenty-nine and four tenths cents ($0.294) on each one hundred dollars ($100) of assessed valuation and that is in addition to all other property taxes imposed by the school corporation for the purpose of funding and maintaining current educational and operational programs including student safety and transportation and any other educational operational needs of the school corporation. |

Because we have a referendum and are asking for a renewal, you will have the SAME TAX RATE of 29.4 cents per $100 of assessed value.

Your Property Taxes Are NOT Going to Increase by 74.85%

In 2017, local residents voted with a 92% approval rating to support the Westview School Corporation’s Operating Referendum that raised the school tax rate to $0.294 per $100 of assessed value.

The public question, not crafted by Westview but by the State, is somewhat confusing if taken at face value and not fully understood. For example, the statement "if extended will increase the average property tax paid to the school corporation per year on a residence within the school corporation by 74.85%" makes it sound like property tax rates are increasing from what they have been. However, because the voters overwhelmingly approved the referendum in 2017, that is the CURRENT tax rate and Westview is asking that the tax rate remain the same, hence the term "referendum renewal." Westview is asking for the exact same value per tax dollar that the community approved in 2017.

On May 6, 2025, the Westview School Corporation is asking residents to renew the 2017 Operating Referendum at the SAME TAX RATE of 29.4 cents per $100 of assessed value. This referendum tax rate helps us to continue our overall $0.75 rate per $100 of assessed value.